この記事では、SoFiを分析します。

ご参考にしていただければ嬉しいです。

(※資料はすべて、https://www.sofi.com/investors/ より抜粋)

※株式の購入を推奨しているわけではこざいません。投資する場合は、自己責任でお願い致します。

※現時点(2021年5月)では未上場ですが、2021年中に著名投資家のChamath PalihapitiyaさんのSPACを通じて、上場することが決まっています。

Contents

- 1 SoFi紹介動画(公式)

- 2 SoFiのミッション

- 3 SoFiの特徴

- 4 差別化

- 5 マーケットの現状

- 6 なぜ複数の口座を開設しているのか(ビジネスチャンス)

- 7 経営陣

- 8 競争力

- 9 メンバー(顧客)成長率

- 10 複数のサービスを使っている顧客数

- 11 費用管理

- 12 クロス購入

- 13 テクノロジー

- 14 GALILEOの買収

- 15 ビジネスの多様化

- 16 ターゲットマーケット

- 17 ビジネスの多角化

- 18 シナジー

- 19 SoFiの成長(EBITDA)

- 20 2025年の予想売上、純利益(Revenue、Profit)

- 21 銀行ライセンス(Bank Charter Licence)

- 22 SoFiのリスク

- 23 SoFiに投資する理由

- 24 寅さんの所感

SoFi紹介動画(公式)

SoFiの紹介動画です。和訳しました。

SoFiとはなんでしょうか。

我々の目標は、人々が財産を正しく運用出来るように手助けすることです。

お金を貯め、消費し、稼ぎ、借り、投資する。

このすべてが一つのアプリで可能になるツールを提供しています。

我々は人それぞれ、成功の意味が異なることを知っています。

負債の清算から、頼れる安全網の構築まで、SoFiが手助けします。

SoFiで、あなたの全般的な消費を管理することが出来ます。

ローンを長期間に借り換えして、毎月の返済金をへらすことが可能です。

負債を統合して繰上返済して一つの口座に集中出来、

ローンを組んで夢のマイホームを購入することも可能です。

投資を始めて、お金に働いてもらうことも可能で、保険に入ることも可能です。

他にも様々な手助けが可能です。

経済的な成功を手に入れたいのでしたら、SoFiアプリをダウンロードするか、sofi.comにご訪問ください。

ほんの数分で投資を始めたり、ローンの利子を確認することが可能です。

SoFiのミッション

顧客が経済的な自由を手に入れる手助けをすることがSoFiのミッション

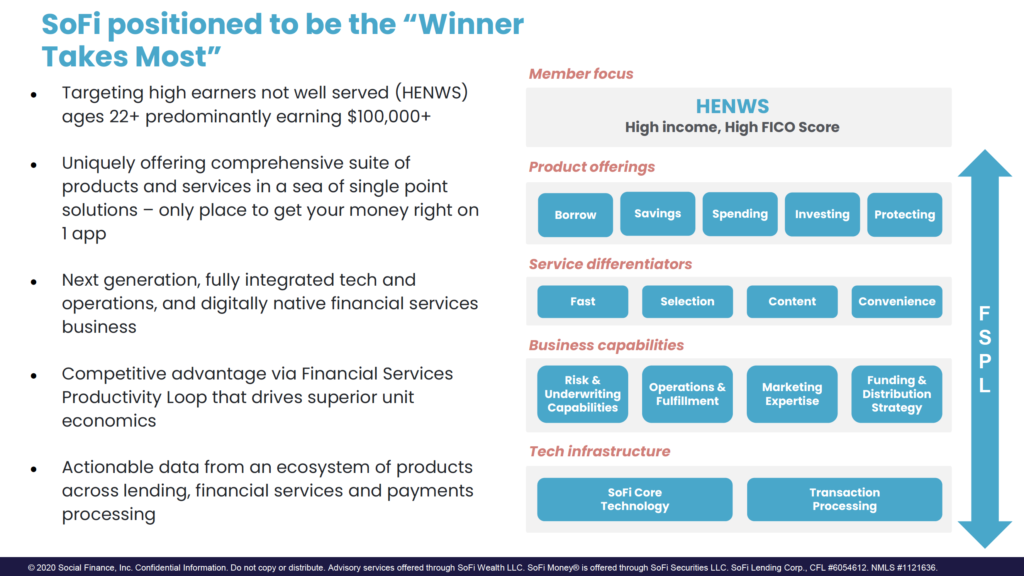

SoFiの特徴

ローン、貯蓄、決済、投資、セキュリティー、など

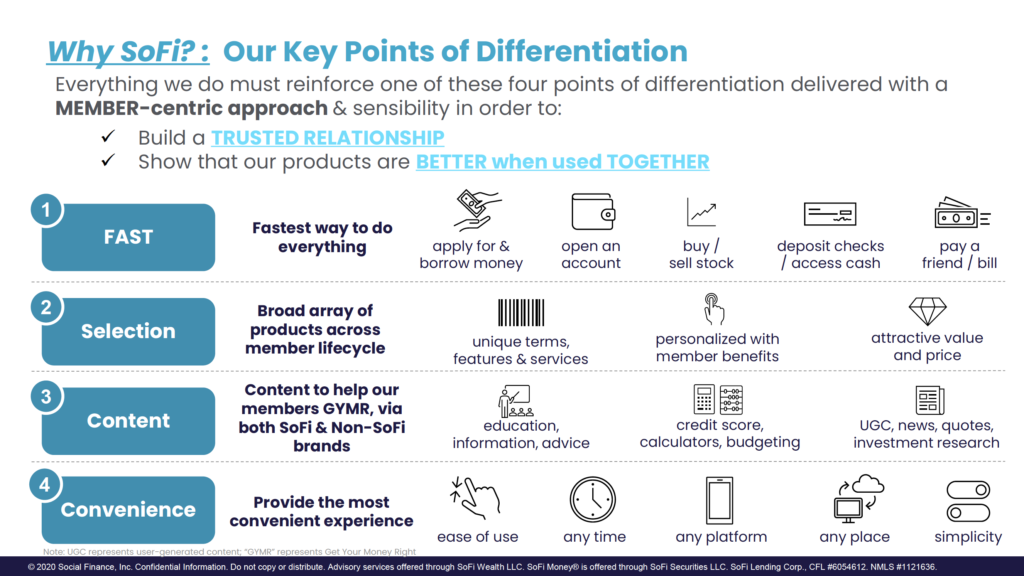

差別化

- 信用をベースとした関係の構築を優先: FinanceにSocialを適用

- 様々な機能を使うことで価値が上昇するシステムを構築

そちらは、金融に限らず、更に多くのサービスを提供しているので、海外(アジア)での競争は厳しいかもしれません。

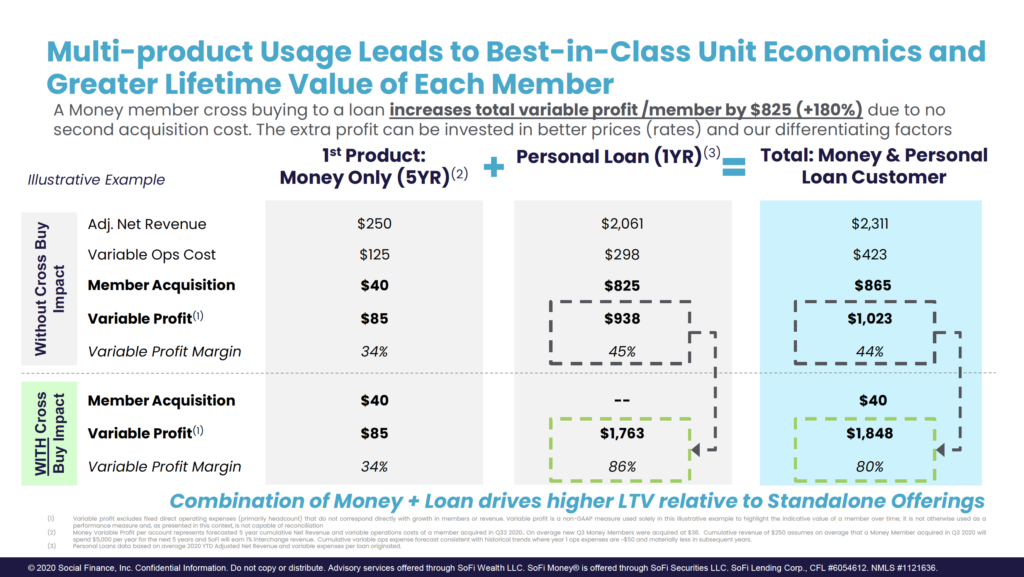

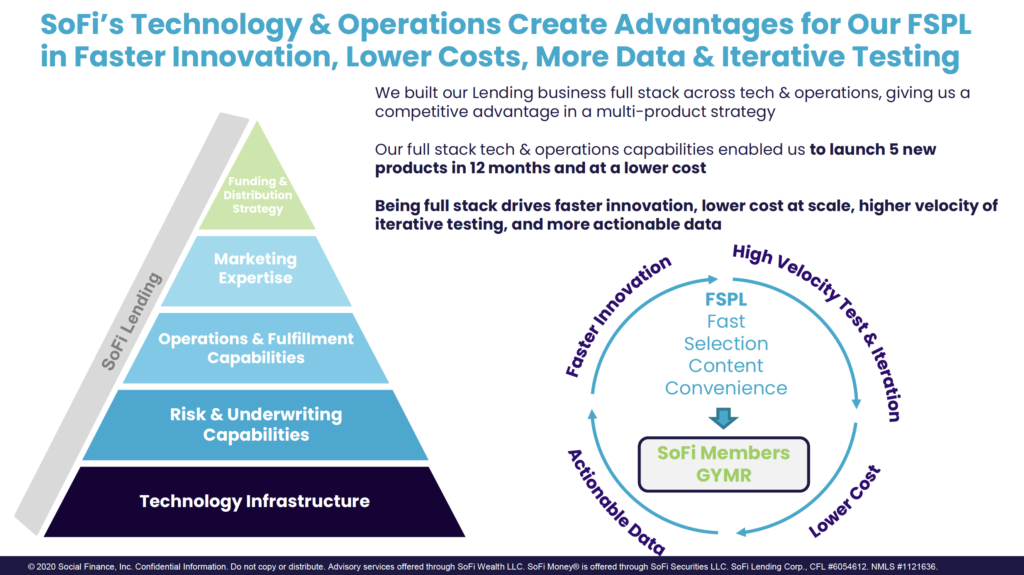

- FSPL(Financial Services Productivity Loop)戦略:芋づる式サービス

- 学資ローン、銀行口座、投資、個人ローン、クレジットカード、住宅ローンなど、個人のすべてのお金の問題を解決

- High LTV(Life Time Value):顧客のライフサイクル当たりの売上を最大化

- Lowest CAC(Customer Accquisition Cost):顧客確保のための費用の最小化

一つのアプリですべて管理できれば便利ですね。

ローンの審査など、信じられないほどアナログでした。

マーケットの現状

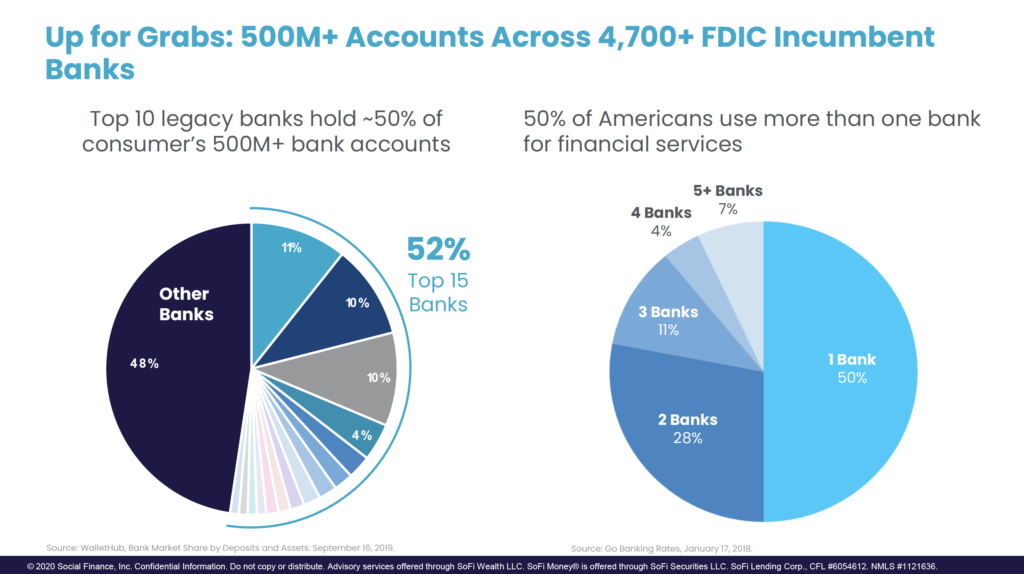

米国人の50%が2つ以上の銀行口座を使用しているとのことです。

なぜ複数の口座を開設しているのか(ビジネスチャンス)

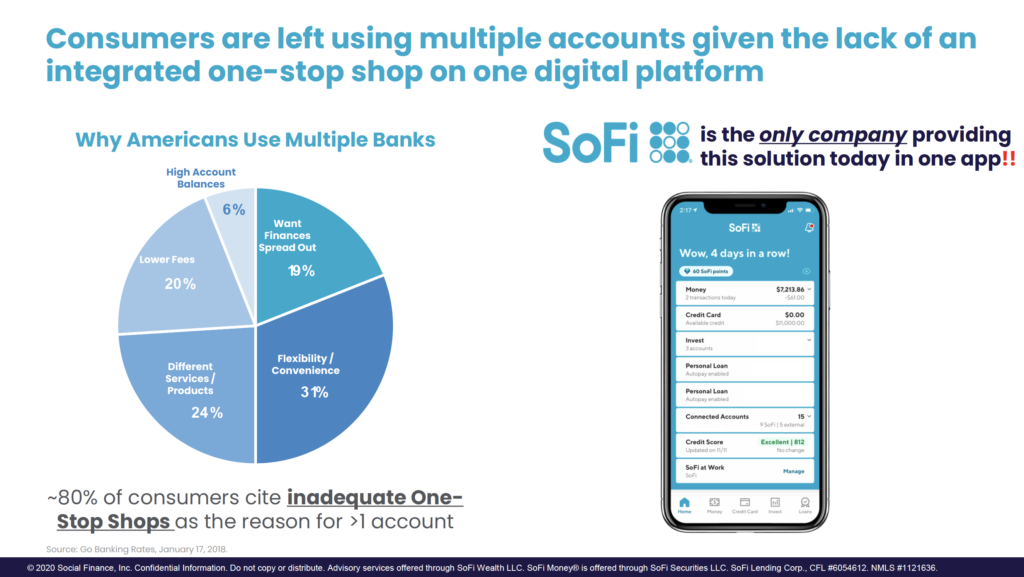

- 80%以上の消費者が銀行口座一つですべてを解決することが難しいと回答

- SoFiは一つのアプリですべてを解決出来る唯一のサービス

経営陣

- Anthony Noteさん:Twitter(Social Media)+ゴールドマン・サックス(Finance)

- Social + Finance = SoFi

TwitterのCOO、ゴールドマン・サックスの役員、NFLのCFOを歴任されたエリートの方です。

投資する際にCEOをチェックする方は多いでしょうから、このような方ですと安心感があります。

競争力

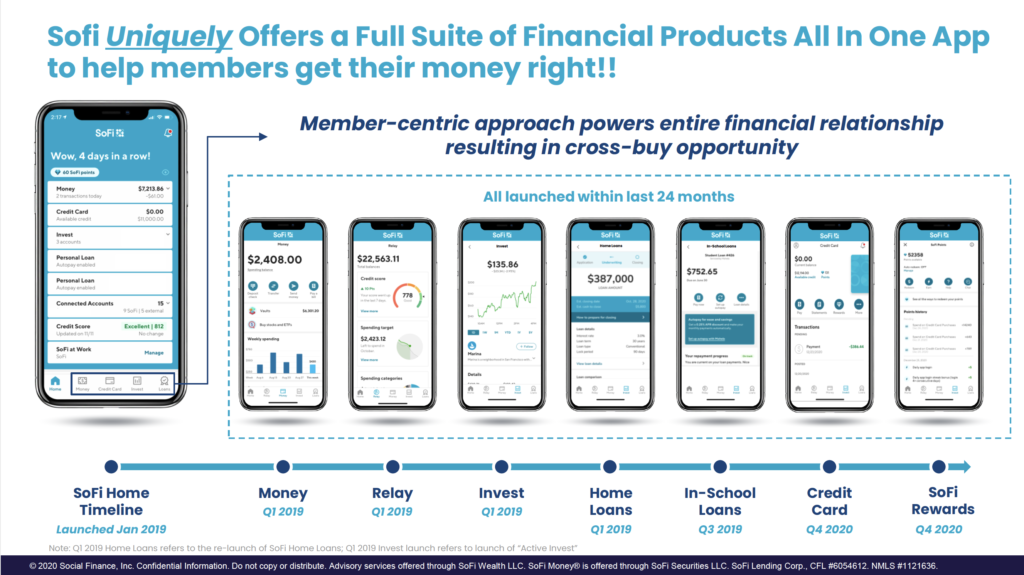

たった2年でこれだけのサービスをローンチ出来るとは驚きです。

メンバー(顧客)成長率

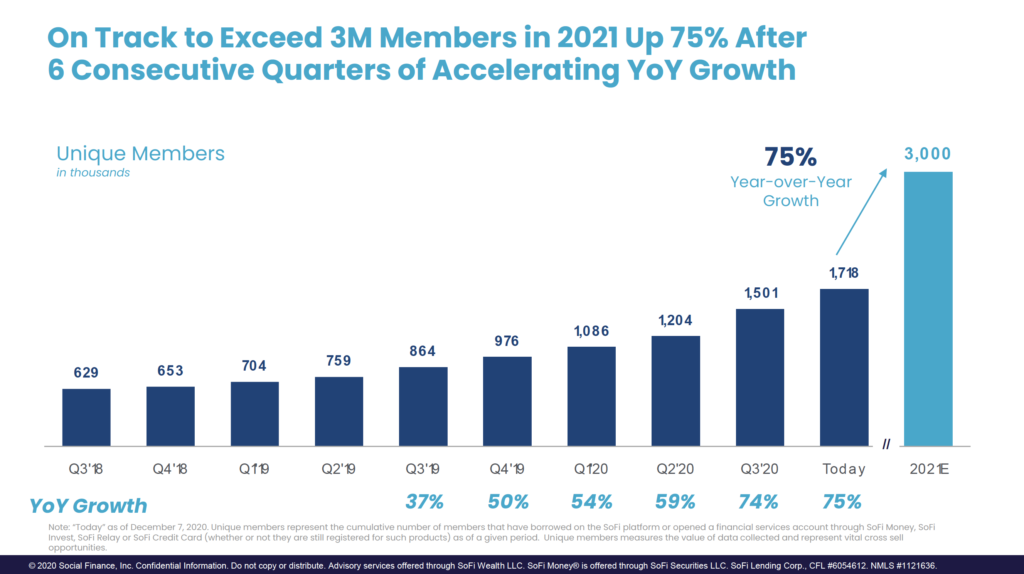

- 2021年予想顧客数:300万人(SquareのCashAppは3000万人)

- 成長率(年):75%(伸びるスピードが早くなっている)

成長率は非常に高いです。

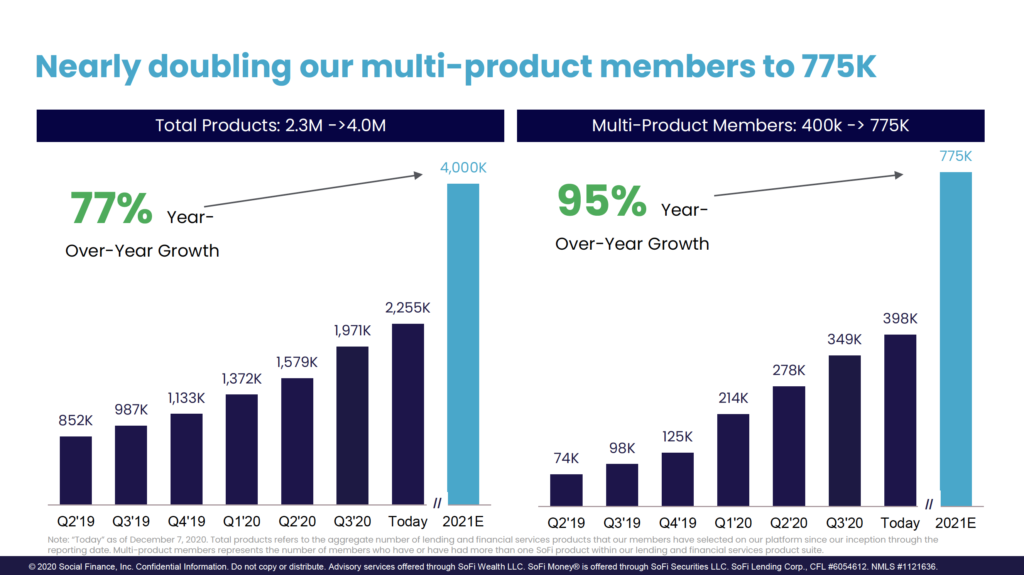

複数のサービスを使っている顧客数

- 現在の40万人から、2021年は77万人以上:95%成長の予測

- 全体のサービス提供数:現在の230万から、2021年は400万:77%成長予測

一度サービスを使った顧客の情報は把握しているので、適切なアプローチができそうです。

費用管理

2020年Q3では、100万ドルの費用で、3000万ドルの売上を確保しています。

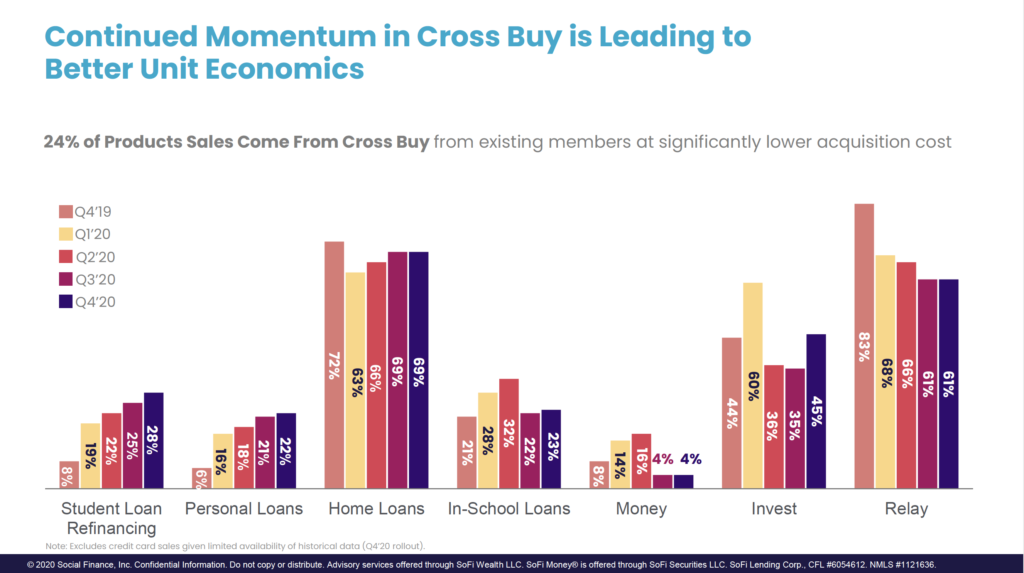

クロス購入

既存客の割合が上がると、売上の予測もしやすくなるので、精度の高い予測が出来そうです。

テクノロジー

過去12ヶ月間5つの新規商品を開発していることが、この技術の証明になっていると思います。

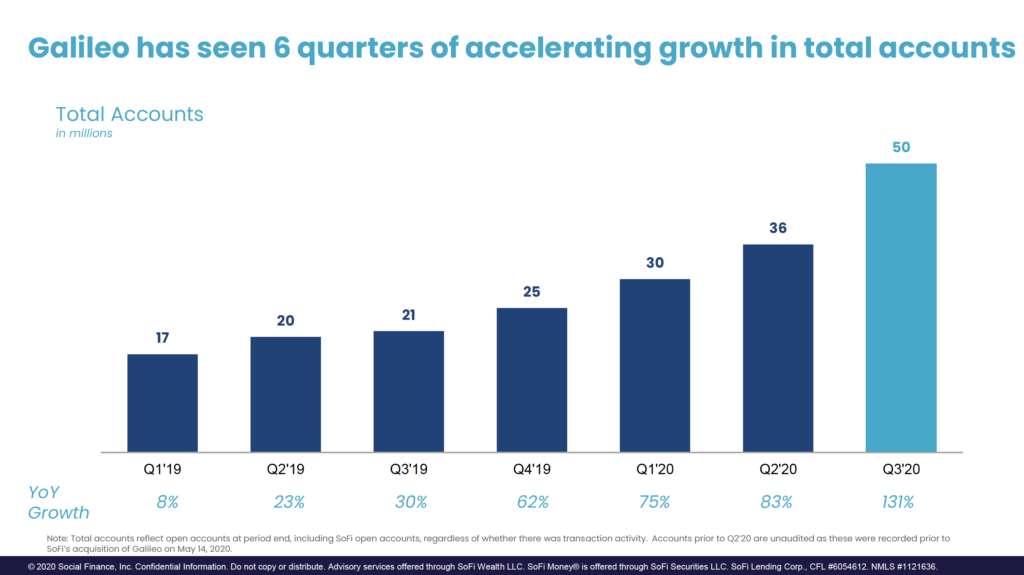

GALILEOの買収

Galileoの顧客の従業員を対処に営業が可能(5000万)になり、南米マーケットへの架け橋の役割を果たすことを期待されています。

同時多発的に、様々なセクターで売上が成長し、収益率向上にもつながるとのことです。

ビジネスの多様化

こちらも成長スピードが凄まじいです。

ターゲットマーケット

ライフステージの変化に合わせて、一つのアプリで顧客が必要なFinanceサービスを一生提供出来ることは非常に強いと思いました。

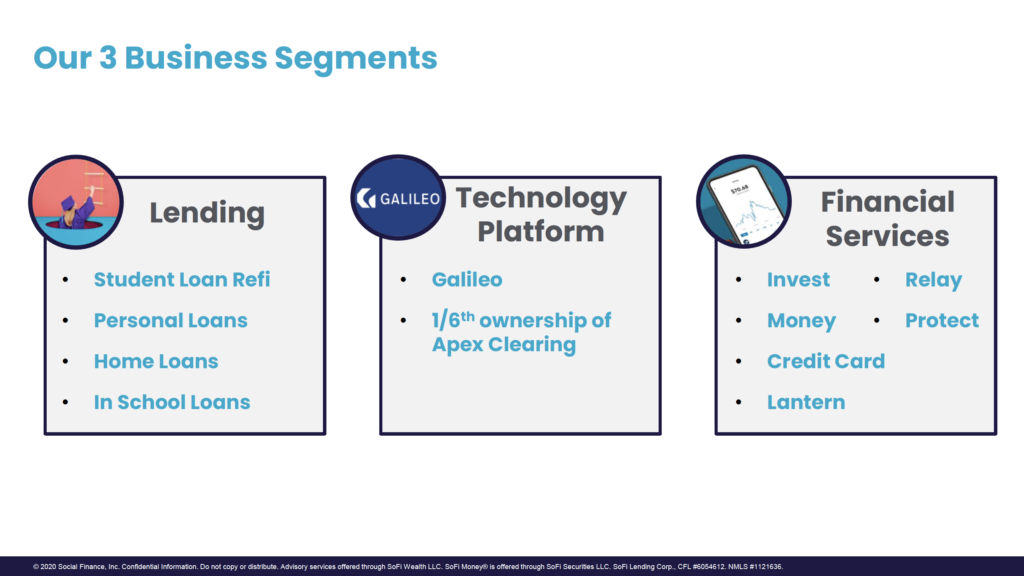

ビジネスの多角化

3つの事業でビジネスを多様化しています。

リスクの最小化につながっていると思います。

金融の世界は変化が早いので、多様化されていると安心感があります。

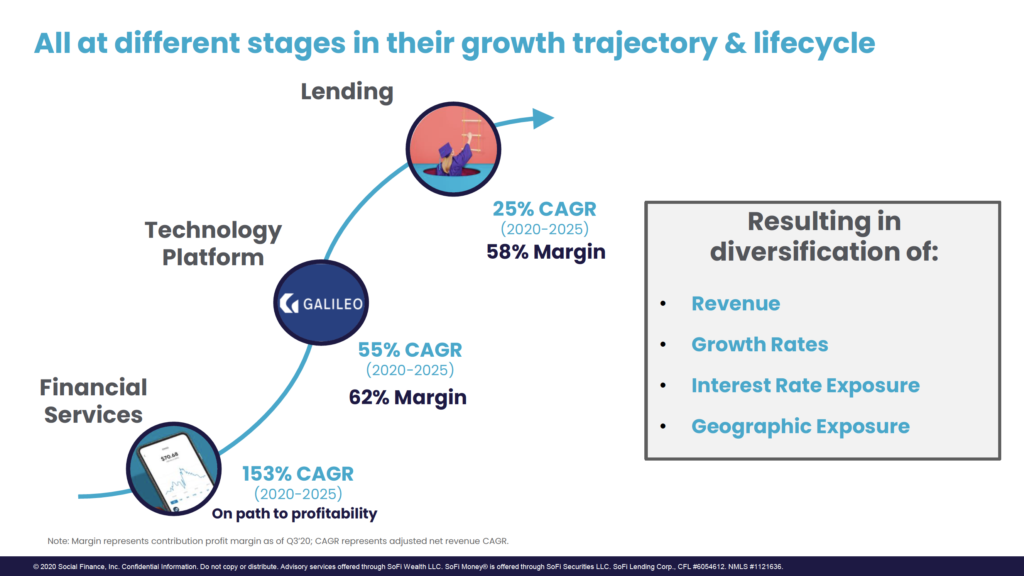

シナジー

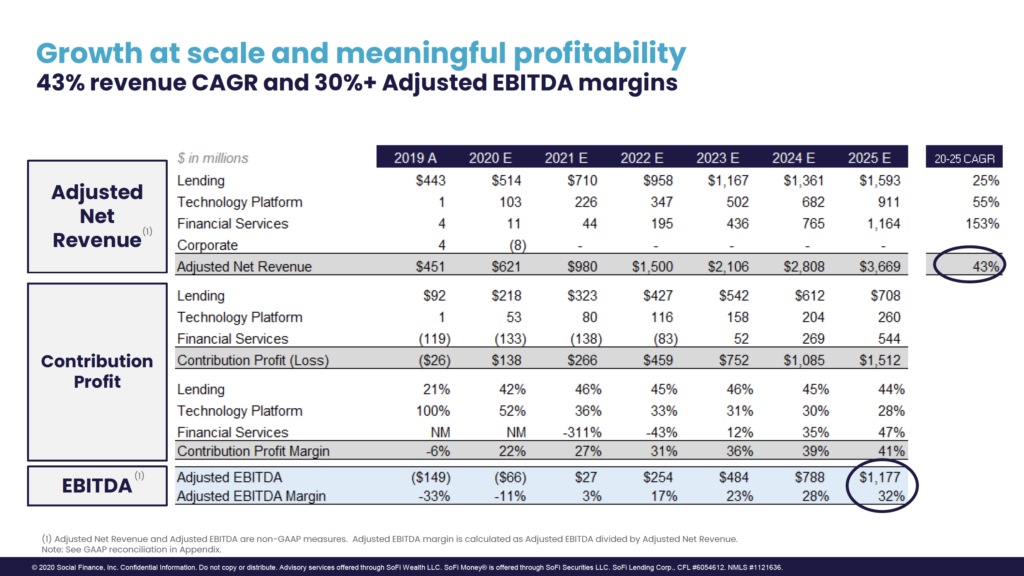

2020年〜2025年の5年間

ファイナンスサービス:成長(年153%の成長率)

ローンサービス:高い利益率(58%)

テクノロジープラットファーム:高い利益率(62%)+高い成長率(年55%)

売上の多角化

2020年売上:ローンビジネスが83%

2025年売上:ローン43%、テクノロジープラットファーム25%、ファイナンスサービス32% を予測

SoFiの成長(EBITDA)

2020年〜2025年までの売上成長率:年43%

2025年のEBITDA収益率:+32%(現在-11%)

規模が大きくなると、色々と節約出来るんでしょうね。

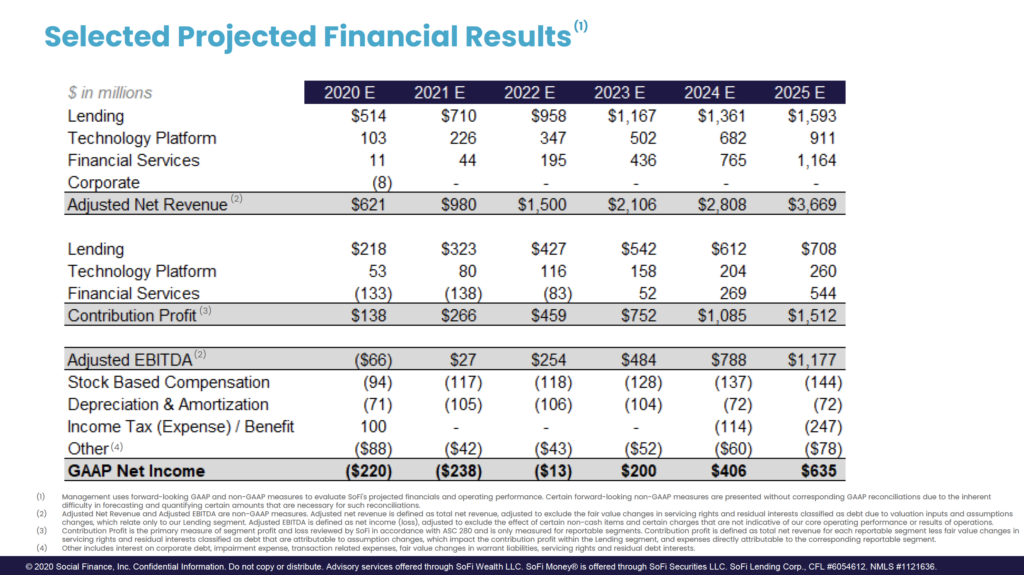

2025年の予想売上、純利益(Revenue、Profit)

2025年の売上予測:36.7億ドル

2023年から黒字化の予測

2025年の予想純利益:6億3500万ドル

2025年のProfit Margin:17.3%

2020年から5年で売上5.9倍

2021年から4年で売上3.7倍

今後4年間、プレミアム(PSR)が半分になっても、株価は2倍近く上昇可能

この成長率を続けられるのなら、何か強力なライバルが出てこない限り、達成出来そうに思います。

Square、PayPalが多角化してくるとどうなるかわからないですね。

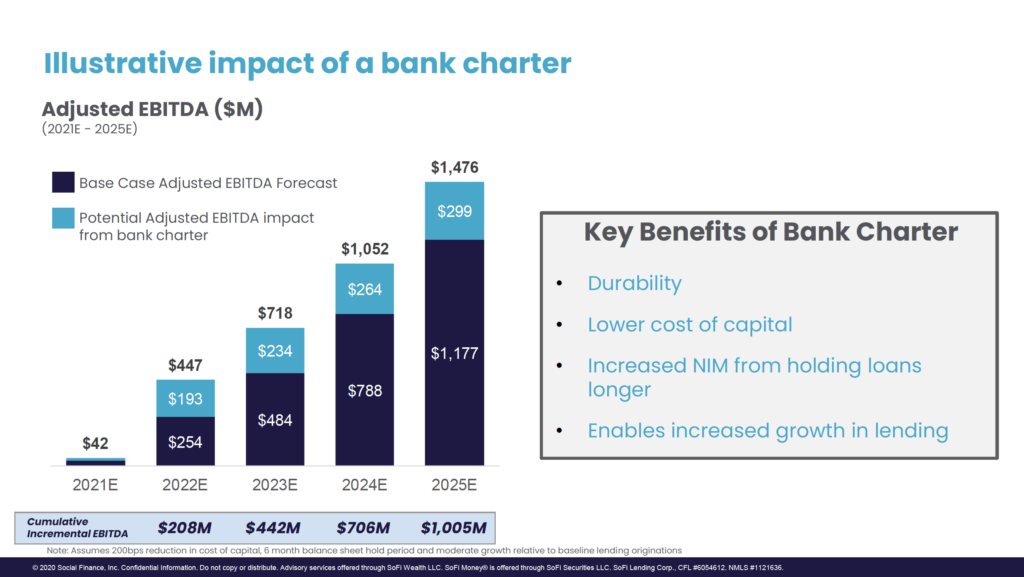

銀行ライセンス(Bank Charter Licence)

- 2020年10月に銀行ライセンスの仮取得済み

- パートナー銀行を通さずに、銀行業務、ローン業務が可能

- 2025年11.8億ドルと予想される、EBITDA収益が14.8億ドルに上昇可能(+25.4%)

このようにさらなる成長の可能性を見せてくれることに魅力を感じます。

SoFiのリスク

① 金融セクターは、破壊的イノベーションが最も急激に起きるセクター。未来予測が難しい(チャンスでもある)

② 既存のFintech企業がライバル(Square、PayPal)

③ 競争の激化(Robinhood、Lemonade、Teslaなど)

④ SPAC株の高い変動率(IPOE)

確かに、SoFiは素晴らしい可能性を持った、理想的なFintech企業ですが、それはSquare、PayPalも同じですから。

また、Robinhood、Lemonadeなどが多角化してきて、競合になる可能性もあると思います。

ただ、セクター全体が伸びるなら、全部伸びる可能性もあるので、過度な心配は必要ないかもしれません。

SoFiに投資する理由

- 2兆ドル規模のマーケット(Financial Industry)

- 300万人のユーザー → 10年で3000万人を目標とする

- CEO(Anthony Noto)がTwitterのCOO・ゴールドマン・サックスの役員を経験(Social + Fin)

- Galileoの買収: BtoB、南米への拡大期待

- Cross Sellingが可能なプラットフォーム

- ビジネス領域の拡大が可能(Ecommerce)

- 2021年〜2025年の4年間の売上成長を3.7倍と予測

- 銀行ライセンス取得出来ればさらなる成長が可能

- 次世代の世界一の投資家(Chamath Palihapitiya)が選択

寅さんの所感

確かに、一つのアプリで、金融サービスを全部利用出来れば、便利だと思います。自分の生活を良くしてくれる企業に投資したいですね。

Chamath Palihapitiyaさん(元Facebook役員)が選んだという安心感もあります。

2021年2月からの小型テック株の下落で、本日(5月27日)時点では2月1日の高値から23%程度下がっています。